End of the Implicit Bargain: a Shift to the Consent-or-Pay Model

For nearly three decades, the World Wide Web operated on an implicit social contract. Users received access to information, entertainment, and services at zero monetary cost. In exchange, they provided their attention and their personal data. This “implicit bargain” fueled the explosive growth of the ad-supported internet. It created a trillion-dollar ecosystem where content is free, but audiences are the product. However, this foundational pact is now fracturing. The digital economy is moving toward a more explicit value exchange known as the Consent-or-Pay model.

The Fracture of the Implicit Bargain

Rigorous data privacy enforcement and technical changes have precipitated a crisis of addressability. The European Union’s GDPR and the UK’s post-Brexit regulations have changed the rules of data collection. Simultaneously, major browser vendors have begun the technical deprecation of third-party identifiers. These factors make the “free” open web economically unsustainable. The traditional programmatic advertising model relies on the ability to track and profile individual users. Without these capabilities, revenue linked to retargeting and cross-domain tracking collapses.

In response to this existential threat, the Consent-or-Pay model has emerged as a new monetization taxonomy. This shift presents users with a binary, often stark, choice. They can consent to full behavioral tracking and personalized advertising. Alternatively, they can pay a monetary fee to access the content without such processing. This paradigm change forces users to acknowledge the value of their data explicitly. It transforms privacy from an abstract right into a tangible economic decision.

Taxonomy and Evolution of the Consent-or-Pay Model

To understand the strategic implications, one must first navigate a complex taxonomy of terms. The Consent-or-Pay model did not emerge in a vacuum. It evolved from earlier attempts to find a defensible position between revenue necessity and regulatory compliance. The precursor to this modern model was the cookie wall. In the early years of GDPR enforcement, some publishers implemented “hard” barriers. These mechanisms denied access to a website unless the user clicked “Accept”.

Regulators generally deemed cookie walls non-compliant. The European Data Protection Board (EDPB) and authorities like the French CNIL ruled that such consent was not “freely given”. Users lacked a genuine choice because they were compelled to consent to access the service. To cure this defect of coercion, publishers introduced the Consent-or-Pay model. By offering a paid alternative, publishers argue they have restored the user’s free will. The user is no longer forced to consent; they simply choose between two forms of payment: data or currency.

In the DACH region, where this model was pioneered, it is known as the PUR model. The core premise is equivalence. The paid service must be a genuine, functional alternative to the ad-supported service. This framework usually presents users with a modal overlay that blocks underlying content. The user then navigates one of two distinct paths: the “Consent” path or the “Pay” path.

Implementation Variations and Economic Desperation

Research identifies three distinct variations of the Consent-or-Pay model currently deployed, each impacting regulatory risk and user conversion differently. The “Binary” or “Hard” implementation is the most aggressive, utilized by tabloids like Bild and The Sun. Users cannot access any content without making an explicit choice, and no “Reject All” button is visible on the first layer. Privacy advocates argue this maximizes coercion.

The “Freemium” variation is used by broadsheets like Le Monde and The Telegraph. Here, the publisher offers a subscription that bundles privacy with premium content, which regulators often view more favorably. Finally, the “Reject Layer” approach, used by The Daily Mail, attempts to meet ICO guidance by including a “Reject All” button that leads directly to a paywall.

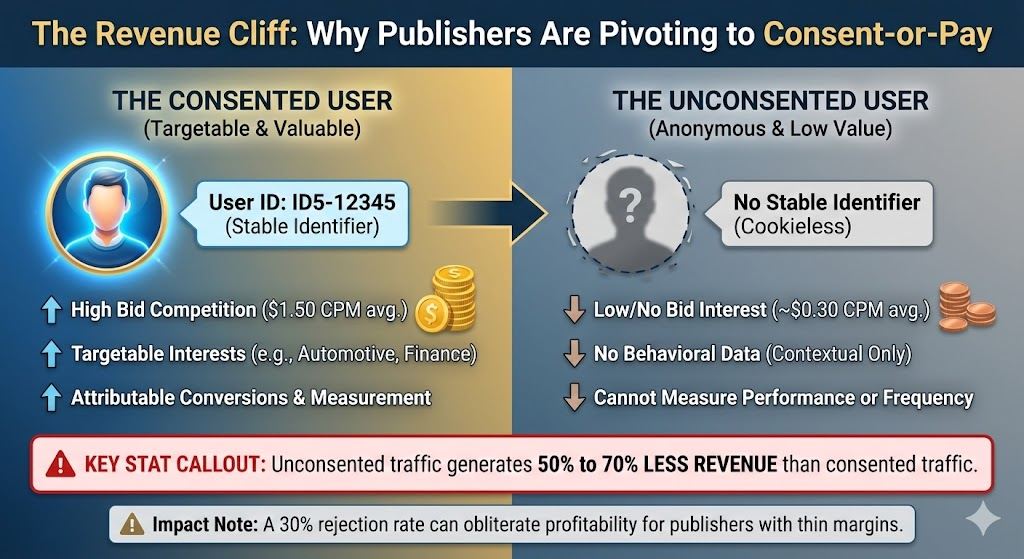

Publishers are risking regulatory ire because the digital advertising ecosystem relies on addressability to match users to target audiences. When a request is consented and contains a stable identifier, advertisers bid competitively, often reaching $1.50 CPM. In contrast, unconsented requests—which lack stable identifiers—see bids drop to roughly $0.30 CPM as advertisers lose the ability to attribute conversions or cap frequency.

Navigating the Global Consent-or-Pay Model Regulations

The legality of these models is currently the most contested frontier in data privacy law. A significant divergence is emerging between the European Union and the United Kingdom. In the EU, the debate centers on the definition of “freely given” consent. The CJEU Bundeskartellamt ruling involving Meta provided the legal foundation. The court stated that platforms are entitled to offer an “equivalent alternative” for an “appropriate fee”.

However, the EDPB issued Opinion 08/2024, which specifically addressed “Large Online Platforms” (LOPs). The Board argued that a binary choice (Consent vs. Pay) generally does not constitute valid consent for tech giants. They advised LOPs to offer a “third way”: a free alternative funded by contextual ads. Following this, the European Commission fined Meta €200 million in 2025 for breaching the Digital Markets Act.

Post-Brexit, the UK ICO has adopted a stance markedly more sympathetic to publishers. Guidance confirms that the Consent-or-Pay model is permissible in principle under UK GDPR. The ICO states that the fee must be reasonable. Crucially, they suggest the fee should reflect the value consumers associate with privacy, rather than the publisher’s lost revenue. The ICO also implied that news media might not be considered “essential services,” allowing them to use the model.

Ad-Tech Orchestration and Strategic Implementation

For ad-tech professionals, the technical execution of the Consent-or-Pay model is critical. Implementation requires sophisticated orchestration between the Consent Management Platform (CMP), the ad server, and the supply chain. The IAB Transparency and Consent Framework (TCF) v2.2 provides the technical backbone. When a user consents, the CMP generates a TC string that enables high-value bid requests.

Managing the “Pay” path is more complex. The CMP must place itself in a state where no vendors are allowed to fire, but the paywall is removed. Publishers must bifurcate their inventory using Key-Values in Google Ad Manager. If the publisher shows contextual ads to paid users, they must enable Limited Ads (LTD). This feature disables the collection of user identifiers and cookies.

Publishers must also disable User ID modules in the Prebid environment for paid subscribers. If an ID module fires for a paid user, it constitutes a GDPR breach. Instead, publishers can use Seller Defined Audiences (SDA). This allows them to signal audience interests without passing a unique user ID. For advertisers, moving tracking to the server-side allows for better control over what data is passed.

Success in 2026 requires a dual-audience strategy. Advertisers can no longer reach the entire audience through a single method. They should target the “Consented Majority” via open auctions. To reach the “Paid Elite,” they must shift budget to Contextual PMPs and Direct Sponsorships. Brand safety now includes compliance auditing of the Consent-or-Pay model. If a brand’s pixel fires on a “Paid” user, the brand could face legal liability.

The Consent-or-Pay model represents the end of the “wild west” of data collection. It marks a maturing of the digital economy where the value of data is priced explicitly. Success will belong to those who master reaching both the tracked majority and the unreachable elite.