Why the Retail Media Explosion Is Over

It’s been a decade since retailers realized they could get rich off of their customers’ eyeballs. And now that the market has topped $100 billion in ad spend, the industry is bracing for a massive wave of retail media consolidation 2026. Retailers are in a panic mode today, as they realize that the “party” is over. For years, the industry has lived off of a simple, seductive gap: the difference between the 3% to 4% thin margins of selling groceries and the 70% to 90% margins of selling digital ads.

This high-margin ad revenue allowed retailers to prop-up their shrinking core businesses and keep prices low enough to please both shareholders and shoppers. However, after a decade of every retailer building their own walled garden, the market has become too messy to manage. The “gold rush” has hit a wall. Insiders are calling this moment “the great correction”.

Retailers Stuck in a Prisoner’s Dilemma Before the 2026 Consolidation

To understand why the market is breaking, you have to look at the prisoner’s dilemma facing retailers. For a long time, there was no reason for retailers to agree on standards. Staying closed was more profitable than opening themselves up. Every retailer treats their transaction data as their best weapon in the war against Amazon. If they started using standard identifiers or sharing that data, they worried it would just become a commodity that anyone could buy.

So instead of working together, every player decided to grade their own homework. They built their own measurement rules and used generous 30-day windows to claim credit for sales. This led to retailers reporting huge returns on ad spend (ROAS) of $10 or $20. In a world with real standards, those numbers would fall apart.

In fact, incrementality—whether an ad actually caused a sale—is usually very low for smaller networks. If a customer is already searching for Tide on a grocery app, showing them a Tide ad is just taxing a sale that was going to happen anyway. This defensive strategy helped retailers protect their revenue for years, but advertisers have finally run out of patience.

How Operational Friction Drives Retail Media Consolidation 2026

As retailers were busy protecting their data, they inadvertently created a “friction tax” that is now scaring away brands. This operational tax is eating into the profits that made retail media attractive in the first place.

For an ad agency, trying to run a campaign across 20 different networks is a nightmare. It means managing 20 different logins, 20 different ways of labeling products, and 20 different billing systems. A small $50,000 test on a niche network now takes as much work as a huge $5 million buy on Amazon. Because of this, agencies are telling their clients to skip the smaller players. It’s not that the audience is bad; it’s that the work required to reach them makes the agency lose money.

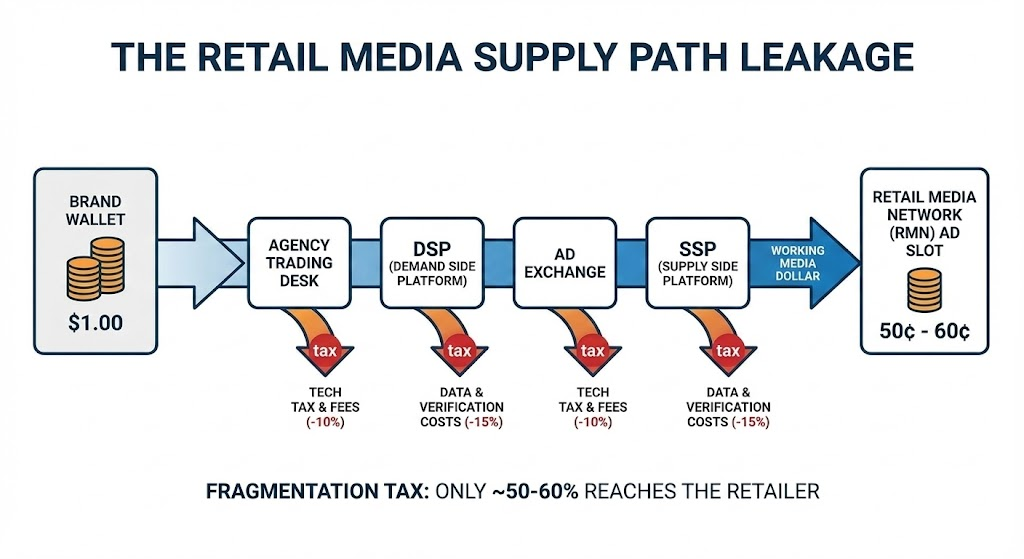

There is also a literal tax on every dollar spent. By the time a brand’s money travels through all the tech middle-men to reach a small retailer, only about 50 to 60 cents of every dollar is actually buying ads. The rest is eaten up by tech fees and verification costs. As a result, brands are moving toward a Rule of Six, where they put 90% of their money into just six major partners. For the hundreds of smaller retailers left out, this is a death sentence.

The High Cost of Proving You’re Legit

The tech gap between the giants and the rest of the market is growing rapidly. Amazon and Walmart have a deterministic golden record—a clear picture of a user that ties together their credit card, address, and shopping history. Smaller networks have to rely on messy data, such as loyalty cards that are only scanned half the time.

When these small networks attempt to find their shoppers online, they lose the trail. If a brand wants 95% accuracy in matching ads to sales, most small networks simply cannot accomplish it. Many small networks refuse to implement new standards because they fear they will reveal how poor their data really is.

Then there is the “Compliance Tax.” Obtaining official accreditation from the Media Rating Council (MRC) is the only way to demonstrate that your numbers are accurate, but the process is prohibitively expensive. For large players, that cost is nothing. For a small network making $50 million, the audit and engineering costs are too high to support.

This has separated the industry into two camps: large players who can afford to be audited, and small players who are losing the trust of the market.

The Career Pivot: How This Will Change Your Paycheck

This shift in 2026 is not limited to strategic decisions within corporations. It is transforming the jobs of everyone in the field. Whether you are an agency trader, a retail executive, or a brand manager, the old way of doing business is gone.

Agency Traders: Manual Campaign Management is Dead

The days of manual management of campaigns for small retailers are gone. Agencies are using Supply Path Optimization (SPO), which allows leverage through automation. Instead of juggling multiple logins, traders are able to automate access to the largest networks. If you fail to learn how to use these automated systems or measure true performance, you may be at risk of losing your job to a computer.

Retail Executives: Easy Money Phase is Over

The “easy money” phase for retailers is over. You are not competing solely with other grocery stores, you are competing with banks like Chase and travel companies like Marriott for the same ad dollars. If you continue to keep your walled garden closed, it is now a career risk. The new goal is to break down your walls and participate in a coalition so you can actually compete for national budgets.

Brand Managers: Enforcers

Brand managers are now the “enforcers”. Their bosses are directing them to cease experimenting and focus on the six major partners that can prove they are truly influencing purchases. Brand managers will soon face performance reviews that move beyond basic Return on Ad Spend (ROAS) and toward EBIT and true profitability. They will be forced to prove that their ad spend does not represent a hidden tax on sales that were destined to occur.

AI Shopping Agents and the Great Cleanup

Retail media has officially entered the performance era, where it will be held to the same high standards as Google and Facebook. Any network that cannot deliver clean, validated data will simply lose its funding.

This is occurring simultaneously with the emergence of agentic commerce. As AI agents begin purchasing items on our behalf, the old banner ads we see while scrolling will become increasingly irrelevant. Since an AI agent makes the decision, a visual ad is worthless. Amazon and Walmart are already adapting their systems to communicate directly with AI agents. Mid-size retailers, which are still trying to create a functional search bar, are being left behind.

Mid-Size Stores Must Join Category Coalitions to Survive Consolidation

To survive, mid-size stores are creating category coalitions. Instead of 50 different grocery networks, we are seeing category-wide entities, such as the United Grocery Media Network, which pools the advertising efforts of many stores. This structural shift is the heart of retail media consolidation 2026. While a retailer may sacrifice their individual brand identity in the ad space, they will obtain the scale necessary to remain competitive.

Amazon, Walmart and several major coalitions will probably control 90% of the future growth, while independent, “long-tail” retailers, which refuse to adapt, will see their ad revenue dwindle to zero. This marks the culmination of retail media consolidation 2026. The gold rush is over; the age of efficiency has begun.