Is AI Destroying Display Advertising?

The current industry line on why open web display advertising is cratering is simple: Artificial Intelligence did it. This theory dominates agency meetings and quarterly earnings calls for the 2024 to 2026 fiscal years, placing the blame squarely on Zero-Click search experiences. The logic is easy to digest. Google AI Overviews and ChatGPT starve publishers of referral traffic by summarizing content directly on the results page. Users get their answer, so they do not click through to publisher websites. Ad impressions evaporate. Naturally, advertisers withdraw budget, claiming the addressable audience has vanished.

The Convenient Scapegoat: Why AI Didn’t Kill Open Web Display Advertising

Our research of the media supply chain suggests the AI story is just air cover for a market correction that is ten years late. Indeed, AI search disrupts traffic patterns, and some publishers report declines of 25% to 50%. But the drop in display revenue is not a freak accident of new tech. Instead, it is the final collapse of a subprime asset class that has failed to withstand the pressure of financial audits for a decade.

This was something my colleagues and I from my two years auditing media saw. That is, we were watching as programmatic display spend turned toxic. Actually, our work has consistently identified the same issue: Made for Advertising sites, fake performance metrics driven by view-through attribution, and a supply chain so opaque that money vanishes before it ever reaches a publisher. This isn’t a traffic crisis as so much a solvency crisis.

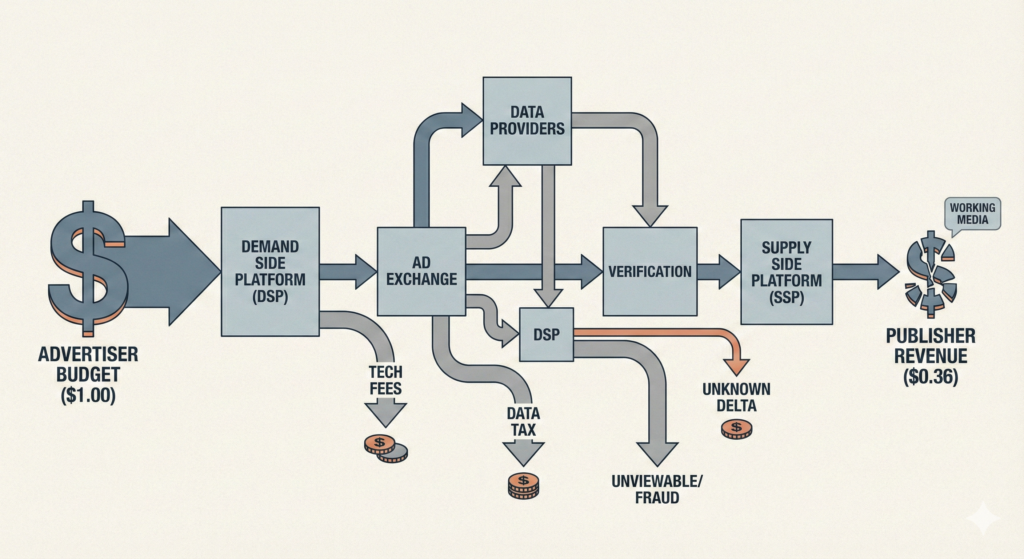

CFOs are finally looking closely at these budgets in 2025. Advertisers are not just fleeing traffic dips. Instead, they are exiting a market with poor results. After all, the Association of National Advertisers found only 36 cents of every dollar reached the consumer in a viewable environment. Brands now want quality. So, they move to Retail Media Networks and Connected TV where attribution is clear. AI is just the coroner; it is declaring the time of death for a period of waste.

Open Web Display Advertising and the Zero-Click Panic

The 2024 and 2025 fiscal years brought the “Zero-Click” phenomenon to the center of information retrieval. Google’s integration of AI Overviews fundamentally altered the exchange between search engines and publishers. Still, predictions from Forrester suggest a 30% cut in open web display advertising spend for 2026. This panic assumes the audience is shrinking.

The logic seems simple. Fewer eyeballs mean fewer ads. Then, money moves elsewhere. Publishers report traffic drops of 25% to 50%. This causes a panic about the top of the funnel. Consequently, agencies tell clients to move to social media and CTV. They want to avoid the volatility of the Open Web.

This narrative relies on one assumption: display advertising was healthy before the AI disruption. Yet, it presupposes budget cuts react to future scarcity rather than past inefficiency. We see this differently. A healthy channel with robust returns would keep its advertisers. Indeed, brands would fight for the remaining high-value audience. They would not abandon the channel entirely.

Brands are leaving very fast. In fact, they were looking for an exit for a long time. The AI search story is a tech excuse covering the write-down of bad assets. Marketing leaders feel pressure to cut costs. So, they find it politically safe to blame market shifts. They avoid admitting previous investments were bad.

Structural Decay in Open Web Display Advertising

The audit reality shows structural rot. Two studies explain this: one is from the Association of National Advertisers and the other is from ISBA. These foundational audits stripped away the veneer of reach and frequency to find a market full of low-quality assets.

The ANA study looked at 44,000 websites for an average campaign. This number shows a lack of care. Clearly, strategy did not drive this scale. Only 36% of ad spend reached the consumer. Transaction costs took 29%. Loss of media productivity took 35%. The loss includes non-viewable ads, bot traffic, and Made for Advertising sites.

An asset class that loses 64% of its value before deployment is a failure. CFOs and auditors flagged this gap for years. Meanwhile, fees and quality issues hid the waste. The collapse is not the same everywhere. Independent publishers on the Open Web are hurting. Yet, Walled Gardens are doing well. Retail Media Networks are growing too.

The death of display is the death of blind programmatic buying on the Open Web. Actually, open web display advertising is declining or flat. Retail Media Networks grew by 23.7%. Connected TV grew by 13.3%. These formats have strong attribution. Conversely, Open Web display has weak attribution. Open Web has many MFA sites. Retail Media uses curated lists.

The History of Banner Blindness

The Open Web was failing for a long time. Of course, AI did not start this. People have ignored display ads for a decade. This is banner blindness. Click-through rates fell below 0.1% by 2023. In fact, the format stopped driving engagement. It became a mechanism for viewability arbitrage.

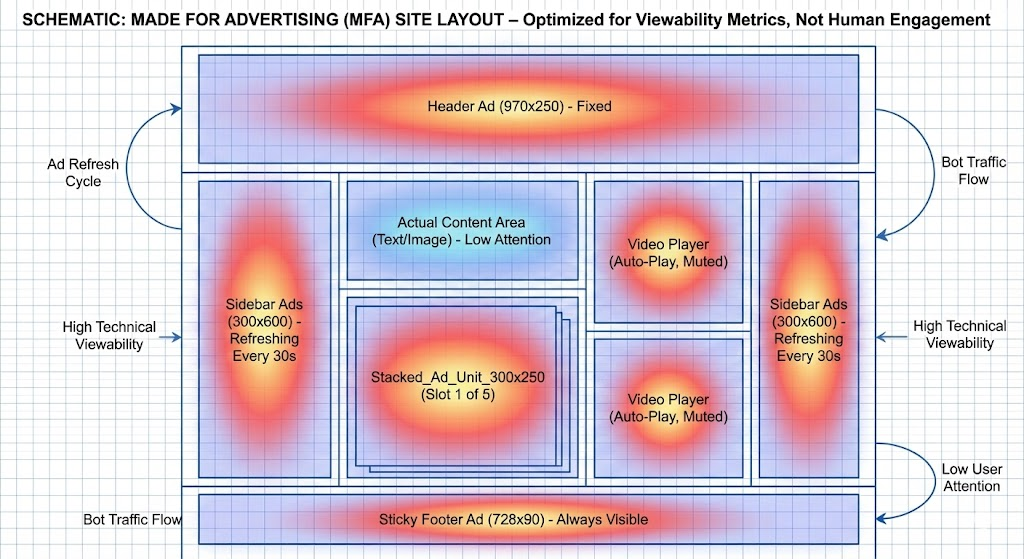

The industry tried to fix this with more volume. So, they used more MFA sites, auto-refreshing ads, and sticky footers. They tried to keep impression volume high. This created a bad environment. Now, auditors are taking the system apart. The AI story ignores the long decay.

The Unknown Delta and Missing Money

Money vanishes in the supply chain. ISBA and PwC found an unknown delta in a 2020 study. This finding altered the risk profile of programmatic investment. Then, they saw 15% of advertiser spend disappear. No vendor or publisher got this money.

Financial controllers see this as a red flag. Indeed, control failures are common here. A market with missing money is ready for fraud and money laundering. The delta dropped to 3% for some groups later. Still, the damage to the ecosystem’s reputation was permanent.

The fix required manual work. Yet, much of the Open Web is still hidden. Advertisers do not see the resale chains. Resellers add no value; they just take a profit. The unknown delta is the financial footprint of these resellers. CFOs do not want these friction costs in 2025.

Made for Advertising Sites and Toxicity

MFA sites are toxic assets that exist to steal ad spend. Usually, they have too many ads and use low-quality content. They trick viewability metrics. Jounce Media said MFA captured 21% of programmatic impressions and 15% of total spend.

MFA sites look good on vanity metrics. In fact, they have high viewability because they force ads into the view of the user. Algorithms look for low costs and high viewability. So, these tools find MFA sites easily. Humans must intervene with lists.

Automation moves money toward MFA inventory. Top brands funded these sites by mistake. Recently, Adalytics found ads for P&G and Unilever on MFA sites. Nestle was there too. Brands slash budgets now. Since cutting this spend did not hurt results, they are moving on. Much of the money went to bot farms.

View-Through Attribution and Fake Value

The industry’s reliance on view-through attribution is an insidious problem. This model gives credit to an ad for a sale when the user merely loaded the ad. Often, the ad might be at the bottom of a page. This creates a bubble of perceived value. Google and Meta use this model by default.

They claim credit for organic behavior. A user wants to buy shoes. An ad loads in the background of a game. The ad takes the credit. Reported returns on ad spend are too high. True lift is often much lower. A campaign might claim a 10.0 return, yet testing reveals a true lift of only 1.0.

Analysts hate this. It is like paying a salesperson for a walk-in sale. 2025 is the year of incrementality. Display looks less efficient now. Fees take a big part of every dollar. DSPs and SSPs take their cut. Data providers take money too.

The ANA confirmed transaction costs are 29%. Quality loss adds to this. Purchasing power on the Open Web is low. Walled Gardens have less friction. Reselling and bid duplication create leaks. Data gaps reach 75% in some cases. Auditors see this as a material reporting weakness. They want to leave the channel.

Spending one dollar gives 36 cents of working media. This is a 64% tax. No other asset class carries such a load. Real estate and equities do not lose this much to fees. Venture capital is cheaper.

Audit Reports That Shook Open Web Display Advertising

Forensic reports destroyed the value story of display. These reports guide budget cuts in 2025. The ANA study is the smoking gun. It quantified the waste that had been anecdotal for years. It found 22 billion dollars of waste. This money went to unproductive tech fees and low quality.

Advertisers started Supply Path Optimization. They cut the number of SSP partners. They moved to direct contracts. Money moved away from long-tail intermediaries. MFA spend dropped from 15% to 6.2%. Jounce Media tracked this drop. MFA share reached 30% once. Algorithms failed to stop it.

Yahoo Backstage is an MFA-free source. Premium inventory commands a premium. ISBA studies showed the match rate. Auditors could match only 12% of impressions in 2020. It was 58% later. Nearly half of transactions are still hidden.

Lack of transparency stops investment. Retail Media Networks fix this. They own the inventory and the data. Discrepancy reports show more friction. The IAB says a 10% gap is acceptable. Gaps reach 20% to 30% in reality.

Bots and latency cause these gaps. A 10% variance on a 10 million budget is a 1 million dollar error. For a CFO, this ambiguity is unacceptable. Advertisers pay for fraud that tools block. This is a phantom loss. Ebiquity looks at contract compliance in 2024 and 2025.

Audits found 1.8 billion dollars in returns for advertisers. This came from unbilled media and gaps. Volume bonuses are common in digital trading. Agencies keep margins that belong to clients. Trust is ruined. Brands move work in-house. They make direct deals with publishers.

Cynicism in the AdOps Trenches

AdOps people have a different view. They press the buttons, are cynical about display, and call it a scam in online forums. Budgets flow to fraud without exclusion lists. Big advertisers avoid admitting they waste billions.

Junior marketers fear making mistakes. They use default settings. This helps waste. Kickbacks are another problem. Agencies get credits from tech partners. They use these to meet guarantees. They do not tell clients the true cost.

The AdOps community sees AI as a useful story. It explains away bad performance. Directors cut budgets to meet efficiency goals. They blame AI shifts. This is safer than admitting last year’s waste. AdOps teams see traffic drops. They blame bot filters and tight attribution.

Agencies use the AI story to sell consulting. They make money from the fear of the tech. Buyers want the Premium Internet. The Trade Desk likes this term. They avoid messy exchanges. They use curated marketplaces.

This follows audit rules for transparency. The Trade Desk has a list of 500 publishers. This is a safe harbor. The rest of the web is not buyable. Buyers use short lists now. They target names like The New York Times.

Zero Based Budgeting and Efficiency

The AI story does not match the timeline. AI search became big in 2023. The decline of the Open Web started earlier. Audit reports in 2020 and 2022 started the shift. Display costs were falling in early 2023. Banner blindness was already high.

Money was already moving to CTV. The fix was financial. 2022 had the lowest display growth in 13 years at 6.4%. Economic worry caused this. It happened prior to ChatGPT changing search. Zero-Based Budgeting is back in 2025.

Every dollar needs proof of value. Reach and brand awareness do not pass the test. Retail Media has better proof. Marketers cut display for mathematical reasons. They cannot hide the waste. Marketing budgets are flat at 7.7% of revenue.

Brands want media that works. The Open Web has high costs. It is the first thing they cut. Brands now use the Marketing Efficiency Ratio. They find that turning off display ads does not hurt revenue. This proves display was taking credit for organic traffic.

The AI excuse hides the fact that traffic did not convert well. Case studies show low results for display. CFOs see these reports and cut the budget. AI is a deflationary force. It makes ad production cheap, which floods the market.

Generative AI creates endless content. This creates too much inventory on MFA sites. It makes the Open Web less attractive. Trash content hurts the value of real publishers. AI helps fraud. Bots behave like humans now.

The Split Internet and New Screens

The internet is splitting in two. One side is the Premium Internet. The other side is the open web display advertising wasteland. It has MFA sites and hidden fees. Third-party cookies are dying. The Open Web lost its main tool.

Retail Media Networks use first-party data. Walled Gardens do too. The Open Web uses guesses. This is less accurate and more expensive. Premium publishers are working together in coalitions to pool data. These are the only safe places to invest on the web.

The Move to Connected TV

Display budgets move to Connected TV. CTV tells stories like TV. It uses data like digital. It is a premium channel with high viewability and low fraud. Brands cut Open Web display by 30% to pay for CTV. They want attention.

The 2025 Upfronts showed this shift. Half of the money went to streaming. Programmatic buying is moving to new screens. The auditor should leave the open exchange model and use curated paths.

Direct-to-publisher deals eliminate resellers. This cuts the 29% tax and removes the unknown delta. Use inclusion lists only. Buy a vetted list of 500 publishers to stop MFA risk. Demand log-level data to audit fee structures.

Use geo-lift tests for measurement. Ignore view-through credit. Move budget to RMNs and CTV. These places have better attribution. The death of Open Web display is a financial story. The industry used hidden fees and fake metrics for too long. Audits showed this rot.

AI Search is a backdrop and a good excuse for traffic drops. It is not the root cause for the failure of open web display advertising. Advertisers leave a market where 64% of the money is lost. CFOs hate this in 2025. They want gated communities and the Premium Internet. The AI story is for people who do not see the math. Brands are done gambling in 2025.